Introduction: Beyond the Green Facade – A World of Plant Communication

For centuries, we’ve viewed plants as silent, stationary beings, largely at the mercy of their environment. We see them as beautiful decorations, sources of food, or essential components of ecosystems. But beneath the surface, a vibrant, complex world unfolds, a world of communication, cooperation, and intricate networks. This is the realm of plant communication, a field that is rapidly transforming our understanding of the natural world. It’s a story of interconnectedness, of plants sharing resources, warning each other of danger, and even exhibiting behaviors we once thought were exclusive to the animal kingdom.

This article delves into the fascinating world of plant communication networks, exploring the mechanisms plants use to interact, the benefits of these interactions, and the implications for our understanding of ecosystems and even agriculture. Prepare to be amazed by the intelligence and resilience of these seemingly passive organisms. We will examine the various ways plants communicate, from the well-studied chemical signals released into the air to the intricate underground fungal networks that connect entire forests. We will uncover the evidence of plant cooperation, competition, and even altruism. This journey will challenge your preconceived notions about the plant world and reveal a hidden universe of remarkable complexity.

The Language of Plants: Chemical Signals, Airborne Messages, and Underground Conversations

Plants don’t have vocal cords or ears, so how do they communicate? They rely on a sophisticated array of chemical signals, airborne messages, and underground networks. These communication methods allow plants to share information about their environment, warn their neighbors of threats, and coordinate their activities. Let’s explore some of the key players in this silent symphony.

Volatile Organic Compounds (VOCs): The Airborne Whispers

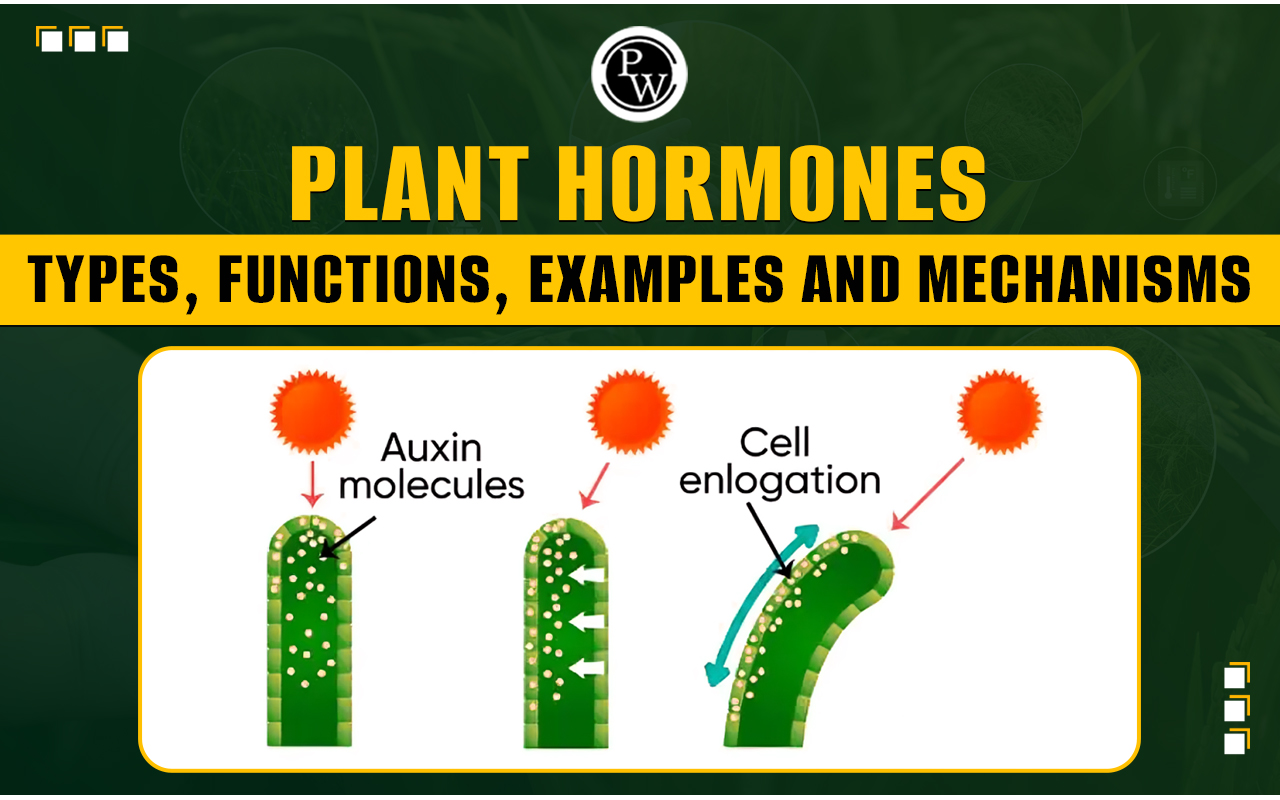

Imagine a forest where trees are constantly exchanging information through the air. This is the reality thanks to volatile organic compounds (VOCs). When a plant is under attack by herbivores, for instance, it releases VOCs into the air. These airborne signals can serve several purposes. They can alert nearby plants, triggering their defense mechanisms, such as producing bitter-tasting chemicals that deter herbivores. VOCs can also attract the predators of the herbivores, providing a form of indirect defense. These airborne signals are incredibly specific. Plants can release different VOCs depending on the type of threat they face, allowing for targeted responses. For example, a tree attacked by a caterpillar might release a different VOC profile than one under attack by a fungal pathogen.

The study of VOCs is a rapidly growing field. Scientists are learning to identify and analyze these complex chemical signals, providing insights into the intricate ways plants interact with each other and their environment. This knowledge has the potential to revolutionize agriculture, allowing us to enhance crop defenses and reduce the need for pesticides.

The Mycorrhizal Network: The Wood Wide Web

Beneath the soil, a hidden world of fungal networks connects the roots of plants. This network, known as the mycorrhizal network or the “wood wide web,” is a crucial component of plant communication and cooperation. Mycorrhizae are fungi that form symbiotic relationships with plant roots. The fungi extend their hyphae (thread-like filaments) into the soil, vastly increasing the surface area available for nutrient and water absorption. In exchange, the plants provide the fungi with sugars produced through photosynthesis.

But the mycorrhizal network is much more than just a nutrient exchange system. It also serves as a communication highway. Plants can use the network to share resources, such as carbon and water, with their neighbors, especially those that are struggling. They can also transmit warning signals about threats, such as insect infestations or disease outbreaks. The network allows plants to coordinate their defenses and collectively respond to environmental challenges. The wood wide web is a testament to the interconnectedness of ecosystems and the power of cooperation.

Root Communication: The Silent Exchange Below

Beyond the mycorrhizal network, plants also communicate directly through their roots. Roots release a variety of chemicals into the soil, including signaling molecules and allelochemicals. Allelochemicals are chemicals that can affect the growth and development of other plants. They can be used to compete for resources, such as water and nutrients, or to warn neighbors of potential threats. Root communication is a complex and dynamic process, influenced by factors such as the type of plants involved, the environmental conditions, and the presence of other organisms in the soil. The study of root communication is still in its early stages, but it promises to reveal even more about the intricate ways plants interact with each other and their environment.

The Benefits of Plant Communication: Survival, Resilience, and Ecosystem Health

Why do plants communicate? The answer lies in the benefits they gain from these interactions. Plant communication enhances survival, promotes resilience to environmental stressors, and contributes to the overall health of ecosystems. Let’s examine these benefits in detail.

Enhanced Survival: Warning Systems and Defense Strategies

Plant communication is crucial for survival. By sharing information about threats, plants can activate their defense mechanisms and increase their chances of survival. For example, when a plant is attacked by herbivores, it can release VOCs that warn nearby plants. These plants can then produce chemicals that deter herbivores or attract their predators. This collective defense strategy increases the survival rate of the entire plant community. Plant communication also helps plants to cope with environmental stressors, such as drought and heat stress. By communicating with each other, plants can coordinate their responses and share resources, increasing their resilience to these challenges.

Resource Sharing: Cooperation in a Competitive World

In the competitive world of plants, resource sharing might seem counterintuitive. However, plant communication allows plants to cooperate and share resources, particularly in times of need. Through the mycorrhizal network, plants can share carbon, water, and nutrients with their neighbors, especially those that are struggling. This cooperative behavior is particularly common among related plants, such as those of the same species. Resource sharing can increase the overall productivity and resilience of plant communities, especially in harsh environments. This cooperation highlights the interconnectedness of plants and the importance of mutual support in the face of adversity.

Ecosystem Health: A Symphony of Interactions

Plant communication plays a vital role in maintaining the health and stability of ecosystems. By coordinating their activities and sharing information, plants contribute to the complex web of interactions that sustain life. For example, plant communication can influence the distribution and abundance of other organisms, such as insects, fungi, and animals. It can also affect nutrient cycling and the flow of energy through the ecosystem. Healthy plant communication networks are essential for a thriving ecosystem. Disruptions to these networks, such as those caused by pollution or habitat fragmentation, can have cascading effects, leading to a decline in biodiversity and ecosystem resilience.

Plant Communication and Agriculture: Implications for the Future of Food Production

The discoveries in plant communication have significant implications for agriculture, offering new possibilities for sustainable and efficient food production. Understanding how plants communicate can help us to develop more effective pest control strategies, improve crop yields, and reduce the need for synthetic fertilizers and pesticides. Let’s explore some of these applications.

Pest Management: Harnessing Plant Defenses

By understanding how plants defend themselves against pests, we can develop more effective pest management strategies. For example, we can use VOCs to attract the natural enemies of crop pests, reducing the need for insecticides. We can also breed crop varieties that are better at detecting and responding to pest attacks. Furthermore, we can use the knowledge of plant communication to develop bio-pesticides that mimic the natural defense mechanisms of plants. This approach can reduce the reliance on synthetic pesticides and protect the environment.

Improved Crop Yields: Optimizing Plant Interactions

Plant communication can also be used to improve crop yields. By understanding how plants share resources and interact with each other, we can optimize planting strategies and improve the efficiency of resource use. For example, we can plant different crop varieties together that complement each other and share resources effectively. We can also use the knowledge of plant communication to develop more efficient irrigation and fertilization practices. Furthermore, we can enhance the mycorrhizal networks in agricultural soils to improve nutrient uptake and water retention, leading to increased crop yields.

Sustainable Agriculture: A Future Rooted in Nature

The insights gained from plant communication research have the potential to revolutionize agriculture, paving the way for more sustainable and environmentally friendly farming practices. By understanding the intricate communication networks that connect plants, we can develop agricultural systems that are more resilient, productive, and less reliant on synthetic inputs. This includes promoting biodiversity, enhancing soil health, and minimizing the environmental impact of farming. This shift towards sustainable agriculture will not only benefit farmers but also protect the environment and ensure food security for future generations.

Challenges and Future Directions: Unraveling the Mysteries of Plant Communication

While significant progress has been made in understanding plant communication, many mysteries remain. Scientists are still working to unravel the complexities of these intricate networks, the specific signals that plants use, and the mechanisms by which they perceive and respond to these signals. Let’s explore some of the challenges and future directions in this exciting field.

Complexity of Signals and Responses: Deciphering the Plant Language

Plant communication involves a complex interplay of chemical signals, airborne messages, and underground networks. Deciphering the plant language is a challenging task, as the signals are often subtle, and the responses can be influenced by various factors, such as the plant species, the environmental conditions, and the presence of other organisms. Scientists are using advanced techniques, such as mass spectrometry and genomics, to identify and analyze the chemical signals involved in plant communication. They are also developing sophisticated models to understand how plants perceive and respond to these signals. Further research is needed to fully understand the complexity of plant communication and its implications for ecosystem function and agricultural practices.

Ethical Considerations: Respecting the Plant World

As we learn more about plant communication, it’s important to consider the ethical implications of our research. We must ensure that our understanding of plant communication is used responsibly and that we respect the plant world. This includes avoiding practices that could harm plants or disrupt their communication networks. It also includes promoting the conservation of plant biodiversity and protecting the ecosystems that plants inhabit. We should strive to develop technologies and practices that benefit both humans and the environment. This involves a shift in perspective, recognizing plants not merely as resources to be exploited but as complex and intelligent organisms worthy of our respect and protection.

Future Research: Expanding Our Knowledge

The field of plant communication is rapidly evolving, with new discoveries being made every day. Future research will focus on several key areas, including the identification and analysis of new signaling molecules, the mapping of plant communication networks in different ecosystems, and the development of new technologies for studying plant communication. Scientists will also explore the role of plant communication in climate change adaptation and the potential for using plant communication to improve crop yields and enhance ecosystem resilience. The future of plant communication research is bright, promising to reveal even more about the fascinating world of plants and their interactions with each other and their environment.

Conclusion: A New Perspective on the Plant Kingdom

The study of plant communication is transforming our understanding of the natural world. We are learning that plants are not passive organisms but active participants in a complex web of interactions. They communicate with each other, share resources, warn of threats, and coordinate their activities. This new perspective on the plant kingdom has significant implications for our understanding of ecosystems, agriculture, and the environment. As we continue to unravel the mysteries of plant communication, we will gain a deeper appreciation for the intelligence, resilience, and interconnectedness of the natural world. We will also be better equipped to develop sustainable solutions for the challenges facing our planet, ensuring a healthier future for all.