Embarking on Your Organic Vegetable Garden Journey

So, you’re thinking about starting an organic vegetable garden? Fantastic! There’s nothing quite like the taste of freshly picked tomatoes, crisp lettuce, or sweet peppers grown right in your backyard. But before you grab your shovel and start digging, a little planning can go a long way toward ensuring a bountiful harvest and a sustainable, thriving garden.

This comprehensive guide will walk you through every step of planning your organic vegetable garden, from choosing the perfect location to selecting the right seeds and managing pests naturally. We’ll cover everything you need to know to create a garden that’s not only productive but also a joy to tend.

Step 1: Assessing Your Resources and Needs

Before you even think about what to plant, take a good look at what you have and what you need. This initial assessment is crucial for setting realistic expectations and avoiding common pitfalls.

Sunlight: The Garden’s Lifeblood

Most vegetables need at least six hours of direct sunlight per day to thrive. Observe your yard throughout the day to see which areas receive the most sun. Note any shadows cast by trees, buildings, or fences. If your yard is mostly shady, you might need to focus on shade-tolerant vegetables like lettuce, spinach, and kale. A sunny spot is non-negotiable for sun-loving plants like tomatoes, peppers, and cucumbers.

Soil: The Foundation of Your Garden

Healthy soil is the bedrock of a successful organic garden. Get your soil tested to determine its pH level and nutrient content. You can purchase a soil testing kit at most garden centers or send a sample to your local agricultural extension office. The results will tell you what amendments you need to add to create the ideal growing conditions. Remember, healthy soil means healthy plants, which are naturally more resistant to pests and diseases. Rich, well-draining soil is key to vigorous growth.

Water: Keeping Your Garden Hydrated

Access to water is essential for a thriving vegetable garden. Consider the proximity of your garden to a water source, such as a hose or rain barrel. Think about how you’ll water your plants – whether by hand, with a sprinkler, or through a drip irrigation system. Efficient watering techniques, like drip irrigation, can conserve water and reduce the risk of fungal diseases. Consistent moisture is crucial, especially during hot summer months.

Space: Maximizing Your Growing Area

Evaluate the amount of space you have available for your garden. Even a small space can be productive with careful planning. Consider vertical gardening techniques, such as trellises and hanging baskets, to maximize your growing area. Raised beds and containers are also great options for small spaces or areas with poor soil. Think about the mature size of the plants you want to grow and space them accordingly to avoid overcrowding. Don’t underestimate the power of a well-organized layout. A small, well-planned space can yield surprisingly abundant harvests.

Time: Your Most Valuable Resource

Be realistic about the amount of time you can dedicate to your garden. Gardening requires ongoing maintenance, including planting, watering, weeding, fertilizing, and harvesting. If you have limited time, start small and choose low-maintenance vegetables. Consider setting aside a specific time each week for gardening tasks to stay on top of things. Remember, gardening should be enjoyable, not a chore! Start with a manageable plot that you can realistically care for, and expand as your confidence and time allow. A small, well-tended garden will always outperform a large, neglected one.

Step 2: Choosing Your Vegetables

Now comes the fun part: deciding what to grow! Consider your climate, your family’s preferences, and the space you have available when selecting your vegetables.

Climate: Growing What Thrives

Choose vegetables that are well-suited to your local climate. Consider your region’s growing season, average temperatures, and frost dates. Cool-season vegetables, such as lettuce, spinach, and peas, thrive in cooler temperatures, while warm-season vegetables, such as tomatoes, peppers, and cucumbers, need warm weather to flourish. Check your local agricultural extension office for recommendations on the best vegetables to grow in your area. Matching your plant selection to your climate is the single best way to ensure success. A plant struggling in the wrong climate will always be more susceptible to pests and diseases.

Family Preferences: Growing What You’ll Eat

Grow vegetables that your family enjoys eating. There’s no point in growing a huge crop of kale if no one in your household likes it! Involve your family in the planning process and let them choose some of their favorite vegetables. This will not only ensure that your harvest gets eaten but also make gardening a more enjoyable experience for everyone. Consider growing a variety of vegetables to provide a diverse range of nutrients and flavors. Think about the dishes you love to cook and choose vegetables that complement those recipes. A garden is, after all, a source of nourishment and enjoyment.

Space Considerations: Growing What Fits

Consider the space requirements of each vegetable when planning your garden layout. Some vegetables, such as tomatoes and squash, need a lot of space to spread out, while others, such as lettuce and radishes, can be grown in a smaller area. Use companion planting techniques to maximize your space and improve your garden’s overall health. For example, planting basil near tomatoes can deter pests and improve the flavor of the tomatoes. Consider using vertical gardening techniques for vining crops like cucumbers and beans. Plan your garden layout carefully to ensure that each plant has enough space to thrive. Overcrowding can lead to reduced yields and increased susceptibility to diseases.

Starting from Seed vs. Transplants: Weighing the Options

Decide whether to start your vegetables from seed or purchase transplants from a nursery. Starting from seed is more economical and gives you a wider variety of options, but it also requires more time and effort. Transplants are more expensive but offer a head start on the growing season. Consider starting some vegetables from seed and purchasing transplants for others. For example, tomatoes and peppers are often started indoors from seed several weeks before the last frost, while lettuce and radishes can be directly sown into the garden. Think about your time constraints and skill level when making this decision. Starting from seed can be a rewarding experience, but it’s not for everyone. Transplants offer convenience and a guaranteed start, but they can be more expensive.

Step 3: Designing Your Garden Layout

A well-designed garden layout can improve your garden’s productivity, aesthetics, and ease of maintenance. Consider the following factors when designing your layout:

Sunlight Exposure: Optimizing Light

Place taller plants on the north side of your garden to avoid shading smaller plants. Group plants with similar sunlight requirements together. Orient rows of plants in a north-south direction to maximize sunlight exposure. Consider the path of the sun throughout the day and adjust your layout accordingly. Remember, sunlight is the fuel that drives plant growth. A well-designed layout ensures that every plant receives the light it needs to thrive.

Accessibility: Making it Easy to Tend

Design your garden layout to make it easy to access and maintain. Leave enough space between rows for walking and working. Consider using raised beds or containers to make gardening easier on your back and knees. Place frequently harvested vegetables near the edge of the garden for easy access. Think about the flow of your garden and make sure it’s easy to navigate. A well-designed layout makes gardening a pleasure, not a chore.

Companion Planting: Harnessing Synergy

Use companion planting techniques to improve your garden’s health and productivity. Some plants benefit each other when grown together, while others can inhibit each other’s growth. For example, planting marigolds near tomatoes can deter nematodes, while planting basil near tomatoes can deter pests and improve the flavor of the tomatoes. Research companion planting combinations to find the best pairings for your garden. Companion planting is a natural and effective way to improve your garden’s health and productivity. It’s also a great way to add diversity and beauty to your garden.

Crop Rotation: Preventing Soil Depletion

Practice crop rotation to prevent soil depletion and reduce the risk of pests and diseases. Rotate your crops each year, planting different vegetables in the same location. This helps to prevent the buildup of soilborne diseases and pests. It also helps to balance the nutrient levels in the soil. Plan your crop rotation strategy in advance to ensure that you’re planting the right vegetables in the right locations. Crop rotation is a key component of sustainable organic gardening. It helps to maintain soil health and prevent the buildup of pests and diseases.

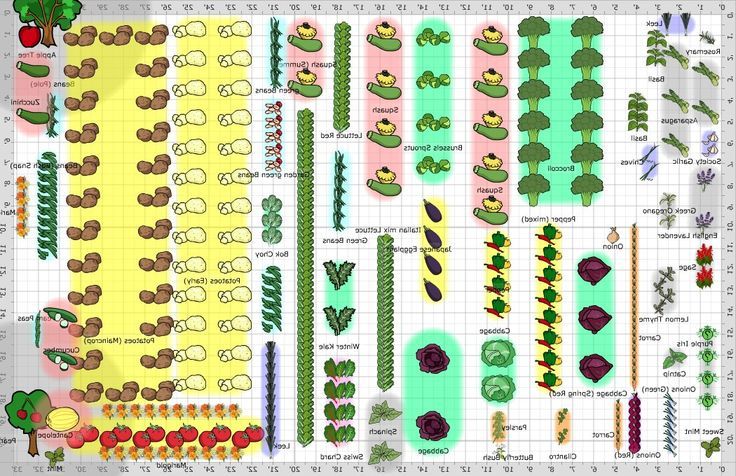

Creating a Visual Plan: Mapping it Out

Draw a map of your garden layout on paper or using a computer program. This will help you visualize your garden and make sure you have enough space for everything you want to grow. Label each plant and indicate its spacing requirements. Use different colors to represent different types of vegetables. A visual plan can help you avoid mistakes and ensure that your garden is well-organized. It’s also a great way to track your progress and make adjustments as needed. A well-planned garden is a productive garden.

Step 4: Preparing Your Soil

Healthy soil is the foundation of a successful organic garden. Before you start planting, take the time to prepare your soil properly.

Testing Your Soil: Understanding its Needs

Test your soil to determine its pH level and nutrient content. You can purchase a soil testing kit at most garden centers or send a sample to your local agricultural extension office. The results will tell you what amendments you need to add to create the ideal growing conditions. Most vegetables prefer a slightly acidic soil with a pH between 6.0 and 7.0. Soil testing is an essential step in preparing your garden for planting. It helps you understand your soil’s needs and make the necessary amendments to create a healthy growing environment.

Amending Your Soil: Adding Nutrients

Amend your soil with organic matter, such as compost, manure, or leaf mold. Organic matter improves soil drainage, aeration, and water retention. It also provides essential nutrients for plant growth. Work the organic matter into the top 6-8 inches of soil. Avoid using synthetic fertilizers, which can harm beneficial soil organisms. Organic amendments are the key to healthy soil and thriving plants. They provide a slow-release source of nutrients and improve the overall structure of the soil.

Improving Drainage: Preventing Waterlogging

Improve soil drainage by adding sand or perlite to heavy clay soils. Poor drainage can lead to root rot and other problems. Raised beds and containers are also a good option for areas with poor drainage. Make sure your garden has adequate drainage to prevent waterlogging. Waterlogged soil can suffocate plant roots and lead to stunted growth. Improving drainage is essential for creating a healthy growing environment.

Controlling Weeds: Starting Clean

Remove any existing weeds from your garden before planting. Weeds compete with vegetables for water, nutrients, and sunlight. Hand-pull weeds or use a hoe to remove them. Mulching can also help to suppress weed growth. Starting with a clean garden is essential for preventing weed problems later on. Weeds can quickly take over a garden if left unchecked. Controlling weeds early on will save you time and effort in the long run.

Creating a Planting Bed: Ready to Grow

Create a planting bed by tilling or digging the soil to a depth of 6-8 inches. Remove any rocks, roots, or other debris. Rake the soil smooth and level. Your planting bed is now ready for planting! A well-prepared planting bed provides a loose, friable soil that is easy for plant roots to penetrate. It also provides a level surface for planting and watering.

Step 5: Planting Your Vegetables

Now that your garden is planned and your soil is prepared, it’s time to start planting!

Timing is Everything: Planting at the Right Time

Plant your vegetables at the right time of year, according to your region’s growing season. Consult your local agricultural extension office for recommended planting dates. Cool-season vegetables, such as lettuce and spinach, should be planted in early spring or late summer, while warm-season vegetables, such as tomatoes and peppers, should be planted after the last frost. Planting at the right time is essential for ensuring that your vegetables have enough time to mature before the end of the growing season. Planting too early can expose your plants to frost damage, while planting too late can result in a reduced harvest.

Following Spacing Guidelines: Giving Plants Room to Grow

Follow the spacing guidelines on the seed packet or transplant label. Overcrowding can lead to reduced yields and increased susceptibility to diseases. Give each plant enough space to grow and thrive. Spacing is an important factor in determining the success of your garden. Overcrowding can lead to stunted growth, reduced yields, and increased susceptibility to pests and diseases. Giving each plant enough space to grow allows it to reach its full potential.

Planting Depth: Burying at the Right Level

Plant your vegetables at the correct depth, according to the seed packet or transplant label. Planting too deep can suffocate the roots, while planting too shallow can expose them to drying out. Follow the instructions carefully to ensure that your plants get off to a good start. Planting depth is a critical factor in determining the success of your garden. Planting too deep or too shallow can prevent your plants from establishing properly. Following the instructions on the seed packet or transplant label will help you ensure that you’re planting at the correct depth.

Watering After Planting: Giving a Good Start

Water your vegetables thoroughly after planting. This helps to settle the soil around the roots and provides them with the moisture they need to get established. Water deeply and regularly, especially during dry weather. Watering is essential for the survival of your plants. After planting, it’s important to water thoroughly to settle the soil around the roots and provide them with the moisture they need to get established. Water deeply and regularly, especially during dry weather.

Mulching: Protecting Your Plants and Soil

Apply a layer of mulch around your vegetables to suppress weeds, conserve moisture, and regulate soil temperature. Organic mulches, such as straw, hay, or wood chips, are the best option. Mulch is a valuable tool for organic gardeners. It helps to suppress weeds, conserve moisture, regulate soil temperature, and improve soil health. Organic mulches are the best option because they decompose over time and add nutrients to the soil.

Step 6: Maintaining Your Garden

Once your vegetables are planted, it’s important to maintain your garden to ensure a bountiful harvest.

Watering Regularly: Keeping Plants Hydrated

Water your vegetables regularly, especially during dry weather. Water deeply and slowly to encourage deep root growth. Avoid overwatering, which can lead to root rot. Watering is essential for the survival of your plants. Water deeply and slowly to encourage deep root growth. Avoid overwatering, which can lead to root rot.

Weeding Regularly: Preventing Competition

Weed your garden regularly to prevent weeds from competing with your vegetables for water, nutrients, and sunlight. Hand-pull weeds or use a hoe to remove them. Mulching can also help to suppress weed growth. Weeding is an ongoing task in the garden. Weeds can quickly take over if left unchecked. Hand-pull weeds or use a hoe to remove them. Mulching can also help to suppress weed growth.

Fertilizing Organically: Nourishing Your Plants

Fertilize your vegetables regularly with organic fertilizers, such as compost tea, fish emulsion, or seaweed extract. Avoid using synthetic fertilizers, which can harm beneficial soil organisms. Fertilizing is important for providing your plants with the nutrients they need to grow and thrive. Organic fertilizers are the best option because they provide a slow-release source of nutrients and improve soil health. Avoid using synthetic fertilizers, which can harm beneficial soil organisms.

Pest and Disease Control: Protecting Your Harvest

Monitor your vegetables regularly for pests and diseases. Use organic pest control methods, such as insecticidal soap, neem oil, or Bacillus thuringiensis (Bt). Remove any diseased plants promptly to prevent the spread of disease. Pest and disease control is an important part of maintaining a healthy garden. Organic pest control methods are the best option because they are safe for the environment and do not harm beneficial insects. Remove any diseased plants promptly to prevent the spread of disease.

Supporting Plants: Giving Structure

Provide support for vining vegetables, such as tomatoes, cucumbers, and beans, using stakes, trellises, or cages. This will help to keep the plants off the ground and prevent them from becoming damaged. Supporting vining vegetables is important for keeping them off the ground and preventing them from becoming damaged. Stakes, trellises, and cages are all good options for providing support.

Step 7: Harvesting Your Vegetables

Harvesting your vegetables at the right time is essential for maximizing their flavor and nutritional value.

Knowing When to Harvest: Picking at Peak Flavor

Harvest your vegetables when they are ripe and at their peak flavor. Consult a gardening guide or your local agricultural extension office for information on when to harvest specific vegetables. Harvesting at the right time is essential for maximizing the flavor and nutritional value of your vegetables. Consult a gardening guide or your local agricultural extension office for information on when to harvest specific vegetables.

Harvesting Techniques: Picking with Care

Use the appropriate harvesting techniques for each vegetable. Some vegetables, such as lettuce and spinach, can be harvested by cutting off the outer leaves, while others, such as tomatoes and peppers, should be picked when they are fully ripe. Using the appropriate harvesting techniques is important for preventing damage to your plants and ensuring that you get the most out of your harvest.

Storing Your Harvest: Preserving Freshness

Store your harvested vegetables properly to preserve their freshness. Some vegetables, such as lettuce and spinach, should be stored in the refrigerator, while others, such as tomatoes and peppers, can be stored at room temperature. Storing your harvested vegetables properly is essential for preserving their freshness and preventing them from spoiling. Some vegetables should be stored in the refrigerator, while others can be stored at room temperature.

Enjoy the Fruits (and Vegetables!) of Your Labor

With careful planning and ongoing maintenance, you can enjoy a bountiful harvest of fresh, organic vegetables from your own backyard. Gardening is a rewarding experience that can provide you with fresh, healthy food and a connection to nature. So, get started today and enjoy the fruits (and vegetables!) of your labor!

Advanced Techniques for the Avid Gardener

Once you’ve mastered the basics of organic vegetable gardening, you might want to explore some advanced techniques to further enhance your garden’s productivity and sustainability.

Succession Planting: Extending the Harvest

Succession planting involves planting the same crop at intervals of a few weeks to ensure a continuous harvest throughout the growing season. This is especially useful for vegetables like lettuce, radishes, and beans, which have a relatively short growing season. By staggering your plantings, you can enjoy a steady supply of fresh produce for a longer period of time. Succession planting is a great way to maximize your garden’s productivity and ensure a continuous harvest.

Cover Cropping: Improving Soil Health

Cover cropping involves planting a crop specifically to improve soil health. Cover crops can help to prevent erosion, suppress weeds, add nutrients to the soil, and improve soil structure. Common cover crops include legumes, grasses, and grains. Cover crops are typically planted in the fall or early spring and then tilled into the soil before planting your vegetables. Cover cropping is a valuable tool for organic gardeners who want to improve soil health and sustainability.

Vermicomposting: Recycling Food Waste

Vermicomposting involves using worms to decompose food waste into nutrient-rich compost. Vermicompost is a great amendment for your garden soil and can help to improve plant growth. Vermicomposting is a sustainable way to recycle food waste and create a valuable resource for your garden.

Seed Saving: Preserving Genetic Diversity

Seed saving involves collecting and storing seeds from your favorite vegetables to plant in future years. Seed saving helps to preserve genetic diversity and ensures that you have a supply of seeds for your garden. Seed saving is a rewarding way to connect with the natural world and preserve the genetic heritage of your favorite vegetables.

Troubleshooting Common Garden Problems

Even with the best planning, you may encounter some problems in your organic vegetable garden. Here are some common issues and how to address them:

Pests: Identifying and Managing

Identify the pest causing the problem before taking action. Common garden pests include aphids, caterpillars, and squash bugs. Use organic pest control methods to manage pests, such as hand-picking, insecticidal soap, or neem oil. Encourage beneficial insects, such as ladybugs and lacewings, to help control pests. Regular monitoring and early intervention are key to preventing pest problems.

Diseases: Recognizing and Treating

Recognize the symptoms of common garden diseases, such as powdery mildew, blight, and root rot. Prevent diseases by providing good air circulation, avoiding overwatering, and practicing crop rotation. Treat diseases with organic fungicides, such as copper or sulfur-based sprays. Remove and dispose of any diseased plants to prevent the spread of disease. Disease prevention is always the best approach.

Nutrient Deficiencies: Identifying and Correcting

Identify the symptoms of nutrient deficiencies, such as yellowing leaves, stunted growth, or poor fruit production. Test your soil to determine which nutrients are lacking. Amend your soil with organic fertilizers to correct nutrient deficiencies. Compost, manure, and bone meal are all good sources of nutrients. Regular soil testing is essential for identifying and correcting nutrient deficiencies.

Weed Control: Staying on Top of It

Stay on top of weed control by regularly hand-pulling weeds or using a hoe. Mulch your garden to suppress weed growth. Use cover crops to outcompete weeds. Avoid using herbicides, which can harm beneficial soil organisms. Consistent effort is key to controlling weeds in your organic garden.

Resources for Organic Gardeners

There are many resources available to help you succeed in your organic vegetable garden. Here are a few:

- Your local agricultural extension office

- Gardening books and magazines

- Online gardening forums and websites

- Local nurseries and garden centers

- Experienced gardeners in your community

Don’t be afraid to ask for help and learn from others. Gardening is a lifelong learning process.

Conclusion: A Rewarding Journey Awaits

Planning an organic vegetable garden may seem daunting at first, but with careful planning and a little effort, you can create a thriving garden that provides you with fresh, healthy food and a connection to nature. So, embrace the journey, learn from your mistakes, and enjoy the rewards of growing your own food!